ENTRY EMA STOCK ANALYSIS CODE

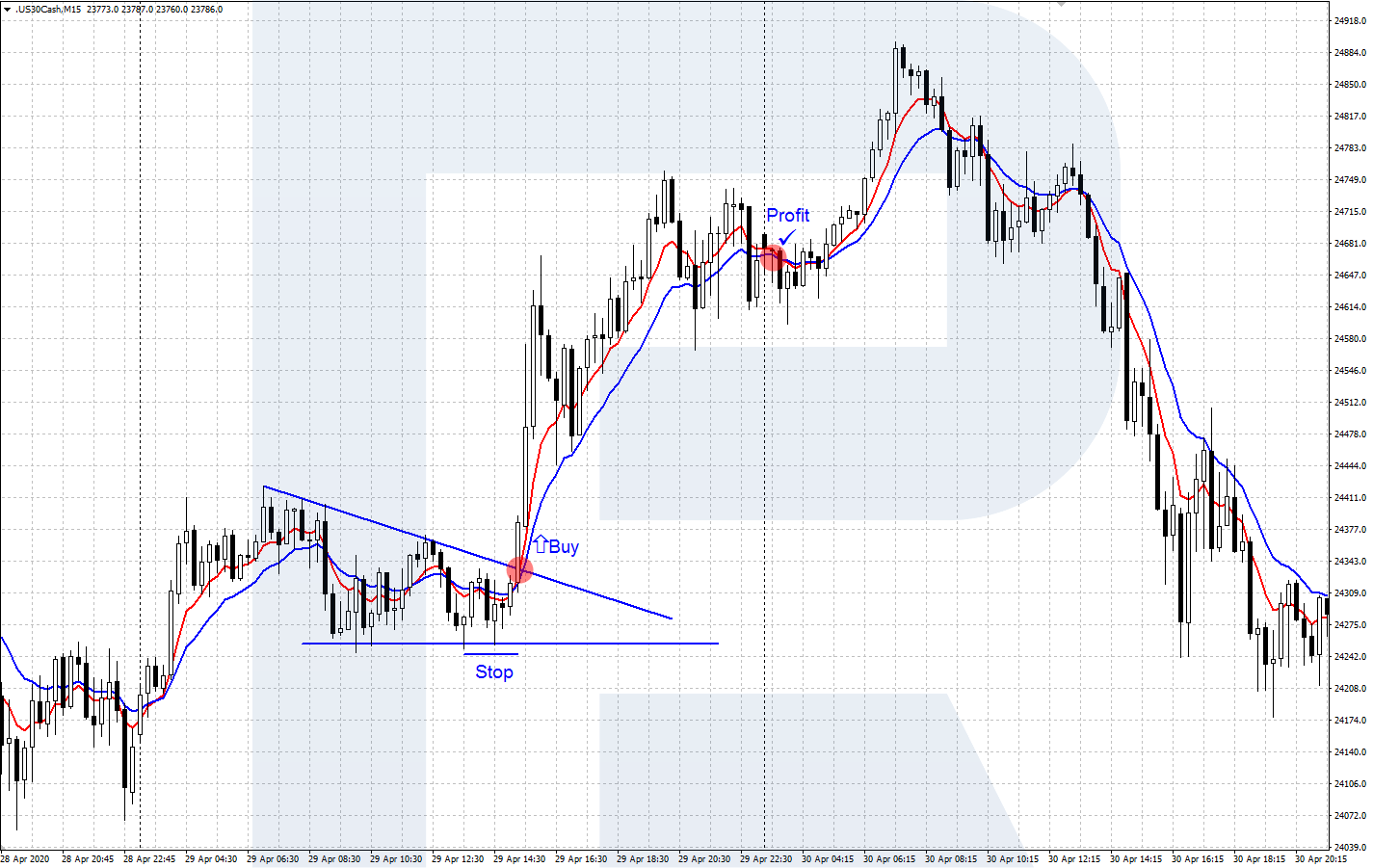

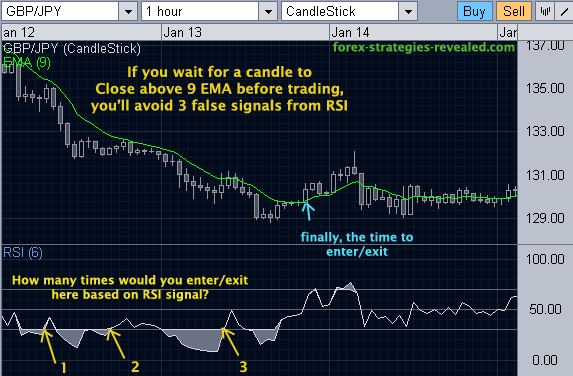

Create your strategy rules: Code your strategy and specify the rules for buying and selling the security.Select Security: Decide which security you want to trade like stocks, futures, options, and currencies.Steps to Implement the 9 EMA Trading Strategy Risk management: This would include position sizing and stop-loss orders.Buy and Sell Signals: It generates buy signals when the price of a given security is above the 9 EMA, and sell signals when the price is below.The indicator: The strategy uses the 9- period Exponential Moving Average (EMA), which can identify the short-term trends in the market.Key Components of the 9 EMA Trading Strategy The 9 EMA can be easily tweaked and used in conjunction with other technical indicators for optimum performance.The 9 EMA is a simple indicator that can be used to trade any financial security.It can help traders to spot trend changes in the market easily.The strategy can be applied to several securities, such as forex, stocks, and commodities. In this strategy, a buy signal is generated when the price of a security moves above the 9 EMA, and a sell signal is generated when the price moves below the 9 EMA. EMA gives more weight to the recent prices, which can help traders to accurately identify market swings. It uses 9-EMA to identify short-term market swings in the price of a security.

The 9-EMA strategy is a technical analysis strategy that uses the 9-day exponential moving average (EMA) to generate buy and sell signals for trading securities. Introduction to the 9 EMA Trading Strategy 9 EMA strategy backtest – does it work?.What Are the Most Popular Variations of the 9 EMA Strategy?.What Types of Markets Can the 9 EMA Strategy Be Used In?.

ENTRY EMA STOCK ANALYSIS HOW TO

How to Combine the 9 EMA Strategy with Other Trading Strategies.What Indicators Can Be Used in Conjunction with the 9 EMA Strategy?.

0 kommentar(er)

0 kommentar(er)